U.S.-China Relations: A Month in Review

Also what to watch for next: Reverse CIFUS, TikTok, China Competition Bill..

Strained U.S. China relations suppressed Chinese equities in May. And the turmoil is definitely not over.

China markets took another dive in May, with the CSI 300 Index (A-shares) down 5.7% and the Hang Seng Index (Hong Kong) down more than 8% last month. The RMB also had a straight-line decline of nearly 3% versus the USD.

It’s hard to say whether the RMB drove down Chinese stocks or vice versa. There is a connection for sure. Foreigners net sold RMB 12.1 billion (USD 1.7 billion) of A-shares through Stock Connect Northbound in May, and they also withdrew from the Hong Kong market. Hong Kong’s daily turnover collapsed to just HKD 71.9 billion (USD 9 billion) on May 30, from a high of HKD 166 billion (USD 21 billion) on January 30 this year.

China had its own problems, such as low confidence and a choppy recovery. No need to regurgitate the headline figures. As someone who lives, works and invests in China, I clearly see the recovery is stalling somewhat. Our crosschecks with U.S. companies in China also confirmed that the near-term outlook is clouded.

Apart from China’s domestic issues, the U.S.-China relations remain one of the largest risks to all Chinese stocks, A-shares, H-shares and ADRs.

I predicted this about three months ago. Click here to learn more.

Let’s take a look at what happened in May that were so detrimental to the U.S.-China relations.

May 8. Chinese foreign Minister Qin Gang met with U.S. Ambassador to China Nicholas Burns in Beijing. Qin reportedly blamed the U.S. for “a series of erroneous words and deeds” (relating to Taiwan), which made the U.S.-China relationship hit an “icy patch”. 😟

May 9. Canada’s top five pension funds testified in the Parliament regarding their investments in China. British Columbia Investment Management (BCI) said it paused direct investments in China, while Ontario Teacher’s did something similar, suspending all new private investments in China. Subsequently, Caisse de dépôt et placement du Québec (CDPQ) followed suite in June, saying it has also stopped making private deals in China and is closing its Shanghai office. Meanwhile, the Canada Pension Plan Investment Board (CPPIB) defended its China investments, saying it still has 9.8% of its assets invested in the country. 😟

May 10. U.S. National Security Adviser Jake Sullivan held “constructive talks” with China's top diplomat Wang Yi in Vienna. This was a rare positive development of the U.S.-China relations in recent months. 😀

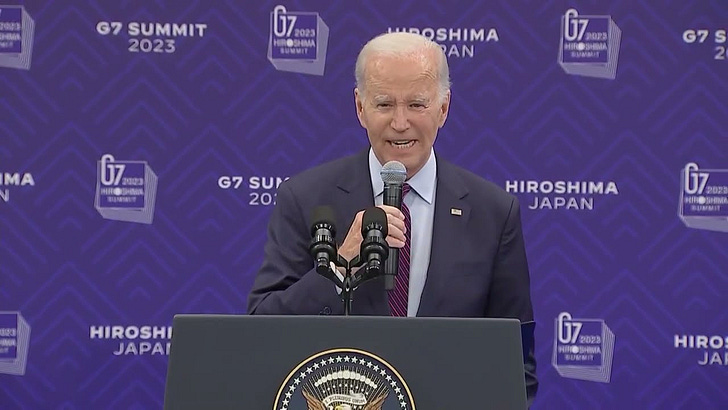

May 19-21. At the Japan summit, G7 leaders reached consensus on China’s “economic coercion”, and called for “de-risking” (rather than de-coupling) from China. China hit back by accusing G7 nations of “smears” and “slander”. 😟

May 21. At the closing ceremony of G7, President Biden mentioned the possibility of lifting sanctions against China’s defense ministers is “under negotiation”. 😀

May 22. Just one day later, the U.S. backtracked Biden’s comments, by saying it has no plans to lifting the sanctions on the Chinese defense minister. 😟😟

May 21. China said products made by U.S. memory giant Micron Technology present a national security risk. Micron products will be banned from key infrastructure projects in China. 😟

May 23. Japan officially announced the export controls of 23 semiconductor manufacturing technologies, effective July 23. Japan already announced such plans in March 2023 to align itself with the U.S. tech sanctions on China. 😟😟

May 23. China’s new ambassador to the U.S. arrived in Washington, D.C. Ambassador Xie Feng said he plans to enhance the U.S.-China relations at a time of “serious difficulties and challenges.” 😀

May 23. U.S. Indo-Pacific Commander Admiral John Aquilino spoke at a National Committee on U.S.-China Relations event in New York. Aquilino warned that invading Taiwan would cost China “blood and treasure”. He added that his efforts are “100% to prevent conflict”, but he is also “prepared to fight and win”. 😟

May 24. Microsoft revealed that China-backed hackers used "stealthy" malware to attack critical infrastructure on American military bases in Guam. China dismissed the report as having a "serious lack of evidence chain". 😟

May 24. A new U.S. congressional committee on China made 10 policy recommendations on Taiwan, in an effort to deter the initiation military conflicts. The Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party plans to make some of its recommendations into law later this year. 😟😟

May 25. U.S. commerce secretary Gina Raimondo met with her China counterpart Wang Wentao at the APEC meeting in Detroit. The U.S. said the two officials had “candid and substantive” discussions, including on the “overall environment in both countries for trade and investment and areas for potential co-operation”. 😀

May 25. Rick Waters, a top China policy advisor at the U.S. State Department, resigned amid the strained U.S.-China relations. 😟

May 26. U.S. trade envoy Katherine Tai also met with China’s Minister of Commerce Wang Wentao. Tai said the U.S. does not seek to “de-couple” from China, and she is “completely open to engaging with” her counterparts from Beijing. 😀

May 27. The U.S.-led Indo-Pacific Economic Framework (IPEF) reached a deal to make supply chains more resilient and secure during possible disruptions. The IPEF includes 14 countries but China. The move is viewed as consistent with the U.S. strategy of “de-risking” from China. 😟

May 29. Wall Street Journal reported that China rejected a proposed meeting between the U.S. and Chinese defense ministers at the Shangri-La Dialogue (June 2-4). This was later confirmed by China. The Chinese government questioned the sincerity and significance of the U.S. invitation, pointing to U.S. sanctions still imposed on Chinese officials (including the defense minister). 😟😟

May 30. U.S. military said a Chinese fighter jet conducted an “unnecessarily aggressive maneuver” in an intercept of a US spy plane over the South China Sea last week. 😟😟

May 30. Elon Musk visited China and met with high-level officials in Beijing. This is his first trip to China in three years. (Incidentally his Twitter also went quiet for three days). 😀

What to Watch For Next

Keep reading with a 7-day free trial

Subscribe to Daily Reflection on China to keep reading this post and get 7 days of free access to the full post archives.