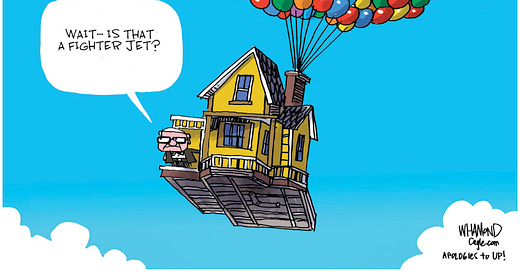

Investment Implications from U.S.-China Relations Post the Balloon

See below a list of collateral damage stocks

A key issue right now is whether China supplies high-tech weapons to Russia. I think not. But if it’s true, the U.S.-China relations will certainly take another dive and open a new can of worms. In that case, no companies are safe from an all-out U.S.-China Trade War, Tech War or other wars. Not even Apple or Tesla.

In any case, the U.S. is trying to suppress China tech at all costs, while causing collateral damages to its own economy and companies. An increasing number of U.S. stocks are now caught in the crossfire of the U.S.-China Tech War, and may not trade on so-called “traditional fundamentals”.

We single out some of these stocks below, noting that (1) they will likely have a lot of idiosyncratic volatility (2) we can’t really understand or control such risk. Investing at the mercy of U.S.-China relations is a different ball game from traditional value investing. Do not underestimate the challenges here.

Keep reading with a 7-day free trial

Subscribe to Daily Reflection on China to keep reading this post and get 7 days of free access to the full post archives.